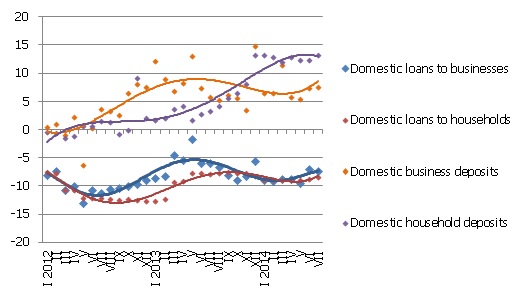

Deposits continue to grow

In July, the money indicator trends were positive, pointing to stability already existing and expected in the coming months. For a second consecutive month, the total amount of domestic deposits attracted by banks has grown. The annual rate of growth on domestic deposits has also increased, reaching 10.6%. The drop in the loan portfolio, on the other hand, has slowed, with the annual drop rate improving to 6.9%.

Business and household deposits in July increased by 0.4%, yet the dynamic by sector differed. As the population became more cautious and thus more likely to accrue, household deposits in July grew by 0.7% (13.2% year-on-year), but the deposits of non-financial businesses, in the meantime, dropped by 0.2% (annual growth rate was at 7.6%), as exports stagnated and economic growth slowed

As far changes in the Latvian contribution to the euro area common money indicator M3 are concerned, the overnight deposits of euro area residents in Latvian credit institutions grew by 1.4% in July and deposits redeemable at notice by 1.8%, whereas deposits with a maturity of up to 2 years dropped by 3.5%. Albeit the amount of cash in circulation dropped slightly, the overall impact of Latvia on the euro area money supply was positive.

In July, the domestic portfolio of loans granted to businesses dropped by a mere 0.1%, with lending to financial intermediary businesses growing for a fifth consecutive month, whereas the portfolio of loans granted to households dropped by only 0.3%, which is the smallest month-on-month drop in the last four years. This resulted from the month-on-month rise in consumer lending by 0.7% and the smallest drop in the balance of housing loans within the last year. The indicator of the annual drop in loans granted to businesses in July was 5.5% and in loans granted to households 8.5%.

Illustration. Year-on-year changes in some money indicators (%)

Source: Latvijas Banka

Risks to the development of exports in the coming months could reduce the accruals of business funds in banks while household deposits with banks could be stimulated by the wish to generate a certain security reserve. With a positive growth of the economy continuing, however, the total level of deposits with banks will slowly continue to rise.

Related to the external risks, we cannot expect particular activating of the lending processes, yet the slowing of the drop rate in July, also in view of the June decision made by the European Central Bank to aid a renewal in lending as well as the ever more frequent information in the mass media on lending to various projects, is a confirmation that banks are resuming lending to businesses.

Textual error

«… …»