Corporate lending resumes growth

In May, Latvia's domestic loan portfolio expanded for the third consecutive month: the monthly growth rate of loans reached 1.1%, a high since autumn 2017, while loans to non-financial corporations increased even faster (by 1.9%). Like in April, deposits only grew in the household sector, whereas corporate deposits and the total amount of deposits declined.

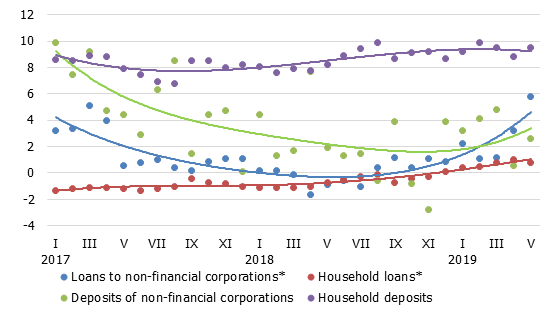

With a rise in loans to non-financial corporations and financial institutions as well as loans to households, comprising both loans for house purchase and consumer credits, the annual rate of change in the domestic loan portfolio improved to –2.2% in May. At the same time, the effect from the banking sector restructuring excluded, the annual rate of change in loans reached 3.6%. With several banks notably increasing the portfolio of loans to non-financial corporations, the portfolio's annual rate of change reached –0.5%, while the figures for lending to households remained more negative and stood at –4.8%. Meanwhile, the effect from the banking sector restructuring excluded, the above annual rates of change were 5.8% and 0.8% respectively. In May, new loans to both non-financial corporations and households increased month-on-month. Moreover, in the first five months of 2019 the total amount of new loans exceeded that of the respective period of the previous year by 9.5%.

While domestic deposits declined by 1.1% in May, the annual growth rate of deposits posted a rise of 7.1%. Deposits contracted primarily on account of annual dividend payments to the general government budget by public enterprises, thereby reducing deposits of non-financial corporations by 5.2%,while the annual growth rate of these deposits increased to 2.6%. Household deposits retained their previous upward trend recording growth rates of 0.6% and 9.5% month-on-month and year-on-year respectively. Latvia's contribution to the monetary aggregate M3 of the euro area decreased somewhat, with overnight deposits of euro area residents with Latvia's monetary financial institutions posting a minor decline. Meanwhile, deposits with an agreed maturity of up to 2 years and deposits redeemable at notice expanded. As a result, the annual growth rate of M3 rose to 14.2% in May, with the above deposits posting increases of 16.9%, 5.7% and 1.3% respectively.

Annual changes in domestic loans and deposits (%)

* For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector have been excluded.

In May, loans continued on an upward trend and in the corporate sector their growth rate even accelerated, with the credit portfolio expanding mostly in the segments of medium- and long-term loans most likely due to investment funding. However, Latvia's economic sentiment indicator has yet to show significant improvement, while the indicators for the EU and euro area even deteriorated in June. Therefore, neither internal nor external factors are likely to support a steeper rise in lending in the near future. With less large purchases planned for the year to come and the future financial situation viewed with more caution, consumer sentiment has also declined in Latvia. Consequently, the household lending growth, which has remained stable for quite some time now, might moderate.

Textual error

«… …»