Corporate lending going up in November

Last November was marked by the steepest rise in loans to non-financial corporations recorded over a period of the last thirty months. This, however, was mostly associated with short-term loans. The amount of new loans issued to non-financial corporations also reached a five-month high and was 28% larger than in November of the previous year. Although household loans for house purchase continued to grow, the overall loan portfolio of households slightly contracted. At the same time, household deposits continued to increase as usual. Corporate deposits with banks grew on account of larger savings by non-bank financial institutions, whereas deposits by non-financial corporations marginally decreased.

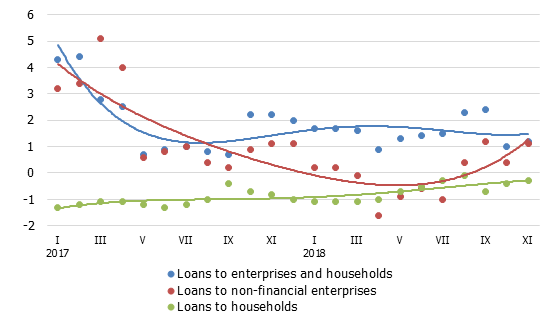

The loan portfolio of non-financial corporations grew by 1.5% in November, while the overall domestic loan portfolio increased by 0.6%, with the annual rates of change amounting to –4.9% and –4.4% respectively or, the effect from banking sector restructuring excluded, to 1.1% and 1.2% respectively. This was primarily a result of a significant rise in short-term corporate loans, with household loans for house purchase recording only a minor increase and consumer credit somewhat shrinking.

Domestic bank deposits grew by 1.2% in November, with household deposits and corporate deposits increasing by 1.1% and 1.5% respectively. Latvia's contribution to the monetary aggregate M3 of the euro area increased by 1.1% in November, with overnight deposits of euro area residents with Latvia's monetary financial institutions and deposits redeemable at notice growing by 0.5% and 0.2% respectively as well as deposits with an agreed maturity of up to two years increasing by 7.7%.

Annual changes in domestic loan portfolio* (%)

*For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector have been excluded.

November results have not changed Latvijas Banka's projections that lending recovery will be very moderate in 2019, as, considering that mainly short-term loans are affected, the overall rise reported in November is unlikely to have a lasting effect. Nevertheless, there is no reason for being pessimistic either, as several long-term lending segments (for example, loans for house purchase) have also shown minor improvement.

Textual error

«… …»