Corporate deposits have notably increased

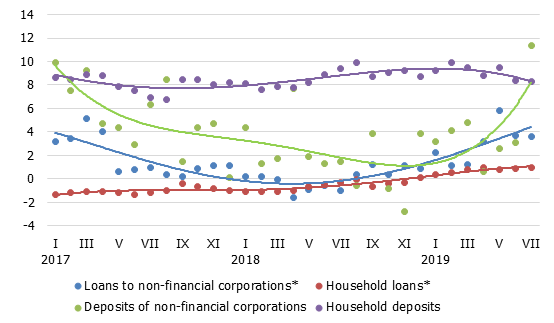

July saw a considerable rise in savings of domestic enterprises held on bank accounts. At the same time, household deposits also continued on an upward path; however, they posted a minor increase during the summer spending season. It should be noted that savings for a rainy day have already been edging up faster since the end of the previous year when economic growth decelerated and uncertainties surrounding future development increased, particularly in the global economic context. The domestic loan portfolio expanded in July, with the loan portfolios of both non-financial corporations and households growing slightly.

Domestic bank deposits increased by 3.0% in July, including deposits by non-financial corporations and households which rose by 8.0% and 0.1% respectively. Although the predominant portion of the increase consisted of balances on settlement accounts, the robust upswing in fixed-term deposits was unusual. This might be attributed to higher-than-before interest rates on corporate fixed-term deposits. Latvia's contribution to the monetary aggregate M3 of the euro area increased by 1.8%, with overnight deposits of euro area residents with Latvia's monetary financial institutions, deposits with an agreed maturity of up to two years and deposits redeemable at notice expanding. As a result, July witnessed the annual growth rate of M3 reaching 9.6% and the above deposits posting increases of 9.9%, 14.3% and 2.4% respectively.

In July, with loans to non-financial corporations, loans to households for house purchase and consumer credit to households edging up by 0.1%, 0.1% and 0.7% respectively, the annual growth rate of the domestic loan portfolio amounted to 2.2% (the annual rate of increase in loans to non-financial corporations reached 3.6%, while that in household loans was 1.0%).

Annual changes in domestic loans and deposits (%)

* For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector have been excluded.

In the period of the slowdown in economic growth and uncertainty, deposit dynamics are not expected to change to a major degree. The loan portfolio will expand slowly despite the fact that the latest results of the euro area bank lending survey suggest that banks anticipate a minor increase in demand for loans to enterprises and for loans to households for house purchase as well as for consumer credit to households. At the same time, development prospects make banks consider tightening lending standards and raising interest rates.

Textual error

«… …»