Bank deposits rise substantially

The rise in bank attracted deposits in July was even higher than in the previous month. During July, the total balance of domestic deposits increased by 135 mil. euro, with both business and household accruals in bank accounts on the rise. Owing to the rise in current account balances, the Latvian contribution to the total money supply of the euro area M3 also rose. The domestic loan portfolio of banks, on the other hand, continued on the slow trend of decreasing, primarily determined by a moderate drop in housing and consumer credit loans granted to households, with the loan investments in business activity remaining unchanged.

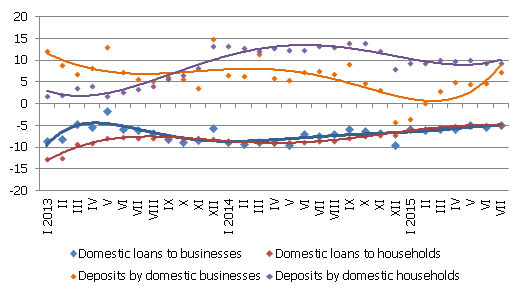

In July, the total balance of domestic deposits attracted by banks increased by 1.4%, with their annual rate of increase reaching 8.4%. The deposits of businesses increased by 2.5% month-on-month and 7.4% year-on-year. Household deposits in July grew by 0.6% month-on-month and their annual rate of increase was 9.3%.

As far as the changes of Latvian contribution to the euro area common monetary indicator M3, the overnight deposits by euro area residents with Latvian credit institutions in July increased by 2.0% and deposits redeemable at notice by 3.0%, whereas the deposits with a maturity of up to two years contracted by 5.4%. Even though the currency in circulation did not change substantially, the increase in deposits ensured a positive Latvian impact on the euro area money supply . Latvia's contribution to M3 increased in July by 1.1%, exceeding the previous July's level by 9.0%.

The domestic loan portfolio of banks in July contracted by 0.3%, including loans to households dropping by 0.3% and loans to financial institutions by 2.3%, whereas loans to non-financial companies remained unchanged. The annual rate of decrease of domestic loans in July was -5.0% for loans to nonfinancial enterprises and -4.8% for loans to households.

Annual change in some money indicators (%)

Source: Latvijas Banka

The rather rapid growth in business deposits indicates that the moderate yet stable growth of the economy allows entrepreneurs to form accruals in their bank accounts. The growing business deposits also increase their potential for investing into the development of production, which is still important, for bank loans do not sufficiently heat the economy. The deposits by households have increased at a slower rate, for the growing incomes of inhabitants have been instrumental in ensuring the rise in retail turnover. The dynamic of deposits confirms the previously made assessments and provides a reason to conclude that in the coming months, a rise in deposits will continue to be the case, with respectable growth year-on-year.

Evaluating the total loan portfolio of banks, we have to note that it is continuing to contract, however in July there was no drop in loans granted to businesses. That corroborates the information provided by the biggest domestic banks (Swedbank, SEB banka) regarding a growing amount of resources allotted to lending to business activity, limited though it is by the lack of quality demand. At the same time, voices have been heard about the development of mortgage lending and the expansion of the state support programme for housing purchases, therefore a positive trend in lending in the medium term is becoming ever more believable.

Textual error

«… …»