Bank deposits on the rise again

After a drop in the first month of the year, in February bank attracted deposits resumed rising, with both businesses and households increasing accruals. The domestic loan portfolio of banks, however, has shrunk slightly, with the annual drop rate of loans remaining almost unchanged.

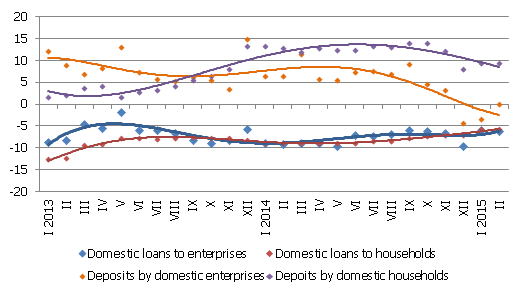

In February, the total balance of bank attracted domestic deposits increased by1.2%, partly covering the losses of January and reinforcing the annual growth indicator. With the non-financial deposits growing substantially and household deposits growing at a more moderate rate, the total balance of bank attracted domestic deposits increased by 4.9% year-on-year (including an increase of household deposits by 9.3% and non-financial institution deposits by 0.1%).

Turning to the changes of Latvia's contribution to the common money indicator M3 of the euro area, the overnight deposits of euro area residents in Latvian credit institutions in February increased by 1.7%, deposits with a set maturity of up to two years by 2.1% and deposits redeemable at notice by 2.3%. Even though the amount of cash currency in circulation in February dropped slightly, Latvia's total influence on the euro area money supply was increasing: the Latvian contribution to M3 grew by 1.9% month-on-month, exceeding the February level of the previous year by 7.7%.

The domestic loan portfolio of banks, including loans to both nonfinancial enterprises and households in February contracted by 0.5%. The annual rate of decrease in loans amounted to 4.5%, including by .6.1% to loans granted to nonfinancial enterprises and by 5.8% to loans granted to households.

The year-on-year changes in some money indicators (%)

Source: Latvijas Banka

The increase of attracted deposits in February indicates that both entrepreneurs and households, despite the slowing down of economic growth, still are in a reasonably comfortable position to increase deposits in their bank accounts. The cautious attitude to spending in this situation provide grounds for expecting a rise in deposits also in the coming months, particularly in the household sector. The tense situation in the area of external demand continues to dampen any activating of business lending. However, the law amendments that took effect in March, which stipulate the possibility of receiving housing loans with or without the possibility of "returned keys", as well as the monetary stimulation measures by the Eurosystem, including the asset purchasing programme launched on 9 March could ensure favourable conditions for the development of lending.

Textual error

«… …»