Bank deposits increased rapidly at the end of the year

Traditionally, December is the month when the highest monthly rise in deposits is observed as businesses close their year and households receive additional revenue during the holiday season. Last December saw the same; moreover, the growth of deposits (+4.8%) was the steepest since the last month of 2013 associated with the coming euro changeover. Despite the fact that the amount of new loans issued to non-financial corporations was higher than that recorded in the previous months of the past year, large repayments of short-term loans at the close of the year led to a minor decline in the domestic loan portfolio both in the corporate and the household sectors.

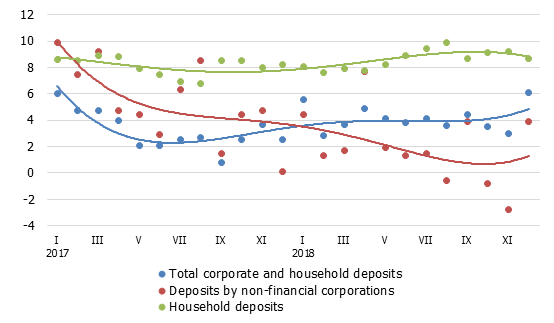

In December, the annual rate of growth of domestic bank deposits amounted to 6.1%, with household and corporate deposits increasing by 8.7% and 2.5% respectively in the course of 2018. Latvia's contribution to the monetary aggregate M3 of the euro area grew by 13.9% in the previous year, with both overnight deposits of euro area residents with Latvia's monetary financial institutions and deposits with an agreed maturity of up to two years expanding by 14.7% and 26.4% respectively, whereas deposits redeemable at notice contracting by 1.3%.

In December, the domestic loan portfolio decreased by 0.4%, inter alia, loans issued to non-financial corporations and household loans declined by 0.3% and 0.2% respectively, with the annual rates of change amounting to –4.3%, –5.0% and –5.4% or, the effect from banking sector restructuring excluded, to 1.2%, 0.9% and 0.1% respectively. The granting of selected large infrastructure development loans in December contributed to the largest monthly volume of new loans recorded in the last four years, i.e. 370.7 million euro, 1.7 times more than in November and 20.4% more than in December 2017.

Annual changes in domestic deposits (%)

With the economic growth remaining moderate, household savings in banks will continue to increase robustly also in 2019, while account balances of businesses will depend on the investment and import needs. Meanwhile, lending will still focus on infrastructure projects in energy and transportation sectors, and the financing of production development oriented investment and house purchase will likewise be on a moderate upward trend.

Textual error

«… …»