Bank attracted deposits have grown substantially

In November, the month-on-month rise in bank attracted deposits was the fastest this year at:+1.9%, including +2.6% for enterprise deposits. Lending indicators, on the other hand, did not change substantially: lending to households and nonfinancial enterprises dropped slightly while lending to financial companies increased. The substantial rise in deposits, despite the drop in the demand for cash currency, led to an increase in the Latvian contribution to the total money supply M3 of the euro area.

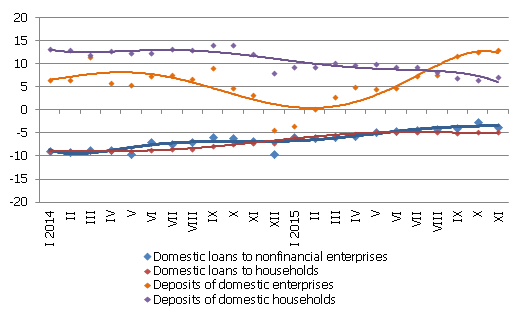

The total balance of bank attracted domestic deposits in November increased by 186 mil. euro, with the rate of their annual growth reaching 9.6% and the deposits of both enterprises and households growing. The rate of annual rise of enterprise deposits reached 12.9% and that of household deposits 7.1%.

The Latvian contribution to the euro area common money indicator M3 was positive. The overnight deposits of euro area residents with Latvian credit institutions in November increased by 3.5% and deposits redeemable at notice by 1.4%, whereas deposits with set maturity of up to two years dropped by 2.2%. In all, Latvia's contribution to the euro area M3 increased by 2.6%, growing 10.3% year-on-year.

In November, the domestic loan portfolio of banks dropped by 0.2%, including loans to nonfinancial enterprises dropping by 0.8% (primarily as a result of being reclassified as loans to financial institutions) and loans to households decreasing by 0.3%. The annual rate of decrease for domestic loans still remained at 3.2%.

Year-on-year changes in some money indicators (%)

Source: Latvijas Banka

The rise in deposits attracted by banks both points to the relatively positive development of the economy and continues to increase the creditworthiness of enterprises and households. Moreover, deposits are growing despite the low remuneration. For instance, in November, the annual average weighted interest rate on term deposits made by enterprises was a mere 0.02% and on that made by households 0.66%. The growing incomes however let the population both to accrue finances in bank deposits and to increase consumption and this situation is likely to continue. In the area of lending the situation seemed to "freeze" in November, yet our expectations of a gradual recovery of lending in the medium term remain in effect. Neither the macroeconomic environment, nor evaluation by market participants indicates that the situation could deteriorate in lending.

Textual error

«… …»