The attraction of deposits speeds up

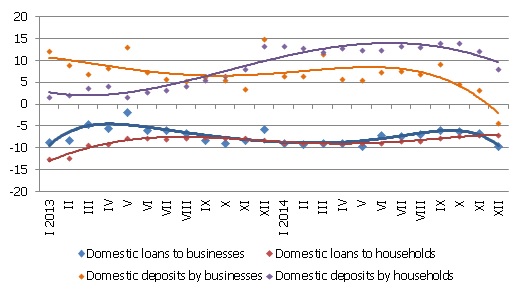

In December, the increase in bank attracted deposits sped up and was the largest in 2014. The loan portfolio, however, decreased rather substantially and lending prospects for the near future are not comforting. In the medium term, lending activity in Latvia could be stimulated by the wide ranging stimulus measures taken by the European Central Bank (ECB).

In December, the total balance of bank attracted deposits increased by 4.0%, which was the fastest month-on-month rise in the last three years, if the extraordinary increase in December 2013, which was related to the introduction of the euro is excluded. The total domestic loan portfolio dropped substantially, which was primarily caused by the repayment of some large short term loans and writing off bad loans, which is characteristic of the end of the year.

As the balance of both business and household deposits rose, the total amount of bank attracted domestic deposits in December rose by 363.3 mil. euro. The base effect – the impact of lats inflows to banks in December 2013 – slowed the rate of year-on-year change (to 3.4%, including that of household deposits to 8.0%, whereas the balance of nonfinancial businesses at the end of 2014 was 4.3% lower than a year ago).

As far as the changes in Latvia's contribution to the euro area total money indicator M3, the overnight deposits of euro area residents in Latvian credit institutions increased by 4.1% in December and deposits redeemable at notice by 18.9%, whereas the deposits with set maturity to two years dropped by 3.8%. The impact of the rise in deposits was supplemented by a seasonal increase in cash in circulation, and therefore the total Latvian impact on the euro area money supply was positive.

The drop of the total domestic loan portfolio of banks by 2.3% in December was primarily determined by writing off loans and repayment of some short-term loans. The balance of loans granted to nonfinancial businesses dropped by 3.0% and loans to households by 1.6%. The year-on-year rate of decrease in loans was 7.1% in December, including 9.6% in loans granted to nonfinancial businesses and 6.7% in housing loans to households.

Illustration. Year-on-year changes in some money indicators (%)

Source: Latvijas Banka

The rapid rise of deposits in December is related both to a seasonal increase in income, including the impact of the high expenditure of the national budget, and a certain amount of caution in outlays, with high uncertainty remaining regarding the developments in the external environment. The first months of the year could bring a seasonal drop in deposits, and in the future, only a moderate rise in deposits can be expected. With the domestic economic growth slowing and the geopolitical tension continuing, a considerable recovery in lending cannot be expected. Although according to the survey of bank lending conducted at the end of December, banks are not planning to toughen their standards in lending to businesses, the economic situation does not permit businesses to increase the demand for loans. With regard to household lending, the standards have been toughened as a result of the adoption of the amendments to the Insolvency Law, and the potential demand for loans has thus been reduced. Future lending activity in Latvia could benefit from the monetary stimulus measures taken by the ECB.

Textual error

«… …»