Another baby step forward in lending

August was marked by slight positive dynamic in the area of lending. After two steps back (in June and July), a baby step forward was made in the lending of nonfinancial enterprises. The portfolio of these loans increased by almost 60 million euro, and the total domestic loan portfolio of banks also grew slightly. The balance of bank attracted deposits also increased slightly, as the accruals of entrepreneurs in their bank accounts continued to rise. On account of an increase in the settlement account, Latvia's contribution to the common money supply of the euro area M3 also rose slightly.

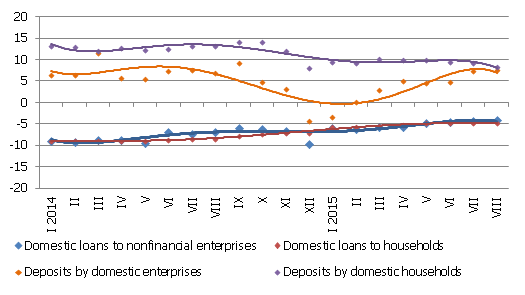

In August, banks' domestic loan portfolio increased by 0.4%, including loans to nonfinancial companies by 0.9% (the fastest month-on-month rise in the last three years) and loans to financial institutions by 1.1%, whereas loans to households continued to drop at the usual moderate rate. The year-on-year drop in domestic loans in August was -3.5%, including -4.2% in loans to nonfinancial enterprises and -4.7% in loans to households.

The total balance of bank-attracted domestic deposits grew in August by 0.4%, with the rate of year-on-year rise at 7.9%. The deposits by enterprises increased by 1.5% month-on-month and 7.5% year-on-year, whereas household deposits dropped by 0.6%, and the rate of their year-on-year growth was at 8.2%.

As for the changes in Latvia's contribution to the total euro area money indicator M3, the overnight deposits of euro area residents with Latvian credit institutions increased by 0.7% and deposits redeemable at notice by 0.1%, whereas deposits with the set maturity of up to two years dropped by 1.5%. Even though the amount of cash currency in circulation dropped, the increase in overnight deposits ensured that Latvia's impact on the euro area money supply was positive. Latvia's contribution to the euro area M3 increased by 0.3% in August, which was a 7.7% increase year-on-year.

Annual changes in some money indicators (%)

Source: Latvijas Banka

The previously expressed assessments of a gradual positive dynamic of the lending processes was supported by the increase in the portfolio of loans granted to nonfinancial enterprises, which allowed the annual rate of decrease in domestic loans to improve in August to an indicator that represents the lowest drop since 2009. Along with the general economic situation, the accessibility of European Union funds, the rise in leasing transactions and continuation of the programme of state support to families for housing purchases, as well as in accordance with the assessments made by banks themselves and the Association of Latvian Commercial Banks, there are grounds to expect that the lending processes will become increasingly positive in the coming months. It is expected that in such circumstances entrepreneurs will also continue to accrue finances in their bank accounts, whereas the deposits of households will grow slower as consumption increases.

Textual error

«… …»