Accruals of businesses with banks growing fast

After the small ebb in January, the finances of depositors once again streamed into banks in February. As a result, the total amount of domestic deposits reached a new record high at 10.5 bln. euro, surpassing even the seasonally high December indicator. The lion's share in contribution to the rise in deposits was made by the increase in the account balances of nonfinancial enterprises, whereas the rise in household deposits was rather moderate. The domestic loan portfolio almost did not change, with the loans granted to households and nonfinancial enterprises dropping minimally and those granted to the nonbank financial institutions rising.

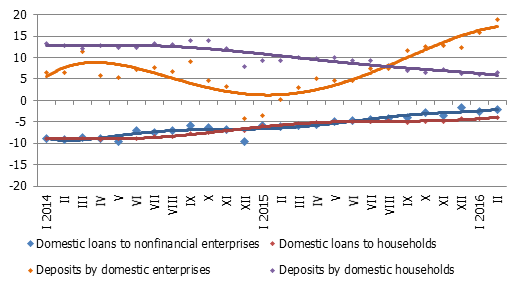

The balance of bank attracted domestic deposits increased in February by 2.7%, with their annual rate of growth reaching 11.9%. Business deposits increased by 5.1% month-on-month and 18.8% year-on-year. The rise in household deposits was more moderate (0.7% month-on-month and 6.4% year-on-year).

Deposit growth also fostered an increase in Latvia's contribution to the euro area common money indicator M3. The overnight deposits of euro area residents with Latvian credit institutions grew in February by 2.9%, deposits redeemable at notice by 3.1% and deposits with a set maturity of up to two years by 0.9%. Overall, Latvia's contribution to the euro area M3 increased by 2.6%, exceeding the level of February of 2015 by 10.4%.

The balance of bank loans to domestic enterprises and households in February dropped by a mere 0.1%, including loans to nonfinancial enterprises by 0.1% and loans to households by 0.2%. The annual rate of drop of total domestic loans improved by 0.4 percentage points to -1.9% (for loans to nonfinancial enterprises it was -2.2% and for loans to households -4.0%).

Picture 1. Year-on-year changes in some money indicators (%)

Source: Latvijas Banka

Both the rise in deposits and the moderate movement to a zero level in the annual rate of change in lending serve to confirm our previous optimistic assessments. Similar trends of change are expected also in the future and, in relation to lending and household deposits, development may be rather moderate. Right now, enterprises are probably forming their accruals by biding their time and accruing capital for investments and co-financing of European Union funds while at the same time increasing their future creditworthiness. In the future, it could make banks' lending policies simpler and foster economic growth.

Textual error

«… …»