Economic growth promotes a rise in money supply

The production output indicators that grew throughout the year and are determined both by the increase in private consumption and export growth, promoted a rise in entrepreneurs’ deposits also in November, at the same time resulting in an increase in total money supply. The domestic loan portfolio shrank slightly, with the loans granted to domestic non-financial enterprises almost unchanged but the household loan portfolio decreasing.

The mood of consumers was positive: the growing income and low interest rates on deposits encouraged more spending, and thus the determining role of entrepreneur deposits became more pronounced in the structure of money supply. In November, business deposits grew 3.6% while the deposits of households increased by only 0.8%; in the first eleven months of the year this proportion was even more striking: 6.5% and 0.6% respectively.

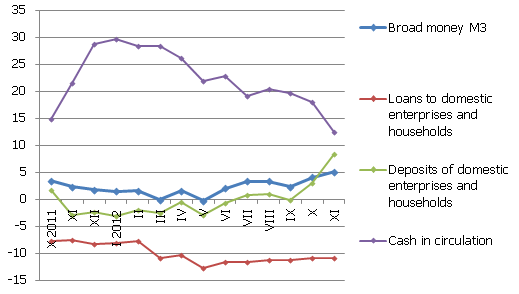

The money indicator M3, which characterizes the amount of cash and non-cash currency in the economy, grew 1.8% in November, posting the fastest rise since December of last year, with domestic overnight deposits growing substantially and – deposits redeemable at notice and the amount of cash currency in circulation increasing slightly. The negative real interest rates on deposits continued to result in the growing income being concentrated in current accounts with banks and term deposits continued to shrink. The dynamic of demand for cash currency finally returned within the limits of a more moderate annual increase, overcoming the impact of the suspension of the activities of "Latvijas Krājbanka" and rumours regarding the performance of some banks observed at the end of last year. Figure: The annual change in some monetary indicators (%)

The annual change in some monetary indicators (%)

Source: Bank of Latvia

The balance of loans granted to non-financial enterprises in November did not change to any notable degree; the rate of annual changes in the enterprise loan portfolio, with the indicators of banks that lost their licences this year, excluded from the base, improved to minus 2.0%, which is the smallest drop since mid-2009. The household loan portfolio continued on its trend of a steady decrease observed as of the end of 2008 (every month it drops within the range of 0.5-1%). Taking into account the stability of deposits by private persons, we can conclude that the financial vulnerability risks of households are continuing to drop.

The November trends in the dynamic of money supply match the overall development observed in the economy and, even though next year a slowing down in growth is possible, no dramatic changes in trends are expected. The rise in income of the population will promote consumption and will act to increase the means at the disposal of entrepreneurs. The latter, in their turn, will have a chance to invest more resources in development, diminishing the overall debt burden and overcoming the current limited borrowing opportunities. As early as next spring, we can predict the lending to enterprises to return to positive annual growth. At the same time, a further improvement in the loan/deposit ratio is expected, reinforcing the stability of the financial system.

Textual error

«… …»