Deposits Resume Rising

After a month's pause, in June the balance of deposits attracted by banks rose once again. As the term deposits increased, so did Latvia's contribution to the total euro area money supply M3. Even though the bank domestic loan portfolio dropped slightly, the annual drop rate of loans improved to -3.6%.

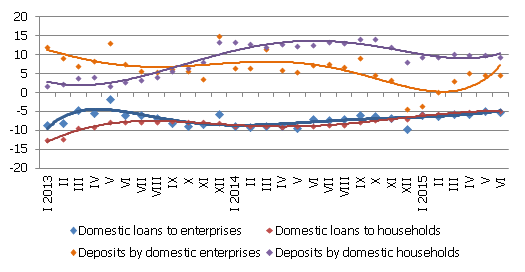

In June, the total bank attracted balance of domestic deposits increased by 0.8%, with their annual rate of increase at 7.3%. Household deposits increased by 0.8% in a month, exceeding the level of the relevant month last year by 9.4%. Enterprise deposits in June also grew by 0.8%, and their annual rate of increase was 4.8%.

As for the changes of Latvia's contribution to the total euro area money indicator M3, the euro area residents' overnight deposits with Latvian credit institutions decreased by 0.3% in June and deposits redeemable at notice dropped by 0.5%, but deposits with the agreed maturity of up to two years rose by 4.3%. This rise compensated not only for the drops in some types of deposits but also the decrease in currency in circulation. As a result, the overall Latvian impact on the euro area money supply was positive, with Latvia's contribution to M3 increasing by 8.5% year-on-year.

The domestic loan portfolio of banks dropped by 0.3% in June, including a drop in loans to non-financial companies by 1.0% and loans to households by 0.5%, whereas loans to financial institutions increased. The annual decrease rate for domestic loans in June was at -2.6% for loans to enterprises (incl. –5.3% for non-financial companies) and -4.8% for loans to households.

The annual changes in some money indicators (%)

Source: Latvijas Banka

The rise in deposits in June and the fact that deposits rose in four months in the first six and their annual rate in all of the months of the second quarter was above 7% points to stability in economic growth and supports the previous assessment that substantial changes in deposit dynamic are not expected. Annual growth will be retained and months of decrease will be rarer than those of increase..

In lending, a change in overall trends has not been observed: in June, the total loan portfolio decreased slightly, yet the decrease would be negligible if, in concluding the first six months, some of the bad loans were not written off. The decrease in loans granted to nonfinancial companies and increase in loans granted to financial institutions were to a great extent determined by reclassification. Thus it can be expected that the rate of decrease in the total loan portfolio will continue to slow down, but a stable growth of the portfolio in absolute terms cannot be expected this year.

Textual error

«… …»