Deposits are on a rise, whereas lending stagnates

After some breathing space in summer, autumn brought the second wave of COVID-19 along with renewed restrictions, both those already introduced in spring and a range of new, stricter ones.

Moreover, the crisis, which had previously seemed to be short-lived, has become increasingly drawn-out and surrounded by uncertainties. Besides, the recent vaccination rollout offers no promise of a swift return to pre-pandemic life. The outlook for economic growth is subject to the evolution of the COVID-19 pandemic; nevertheless, the government support measures for households and businesses, the use of the European recovery funding and the favourable financing conditions ensured by the accommodative monetary policy have dampened the negative impact of the crisis on the economy.

The situation in the financial sector has remained stable, with deposits increasing markedly and lending stagnating, thus continuing the pre-crisis trends. However, the loan portfolio did not see a notable contraction. With the COVID-19-related restrictions tightening, consumption in the entertainment and tourism sectors became increasingly inhibited. Moreover, households focussed more on accumulating precautionary savings for the crisis which seemed to have no end in sight. Thus, bank deposits continued on an upward trend, which may have been reinforced by the preparations for the largest seasonal spending in December. At the same time, the sentiment of businesses and consumers deteriorated, and their appetite for borrowing declined. Only loans to households remained on a slight upward trend. It should be noted, however, that large amounts of new loans, inter alia, loans to businesses, were granted as the crisis had not affected all sectors.

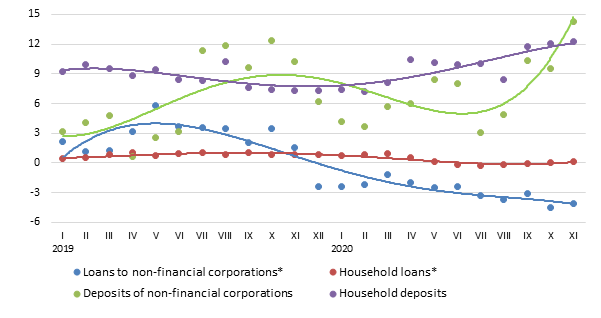

In September–November, domestic deposits increased by 5.8%, with household deposits growing by 3.4% and deposits by non-financial corporations increasing by 6.1%. In November, the annual growth rate of domestic deposits reached 14.8% (a 12.2% increase in household deposits and a 14.3% rise in deposits by non-financial institutions), the highest level in the past 13 years. The increase in cash balance (6.3%; 20.5% year-on-year) accounted for a lion's share of the overall rise in deposits.

In September–November, the domestic loan portfolio contracted by a mere 0.02%, with loans to non-financial corporations declining by 0.6%, but the loan portfolio of households increasing by 0.5%. In the past three months, lending to non-bank financial institutions also expanded somewhat (by 0.4%). The annual rate of change in domestic loans (excluding the impact of the restructuring of the banking sector and the reclassification of institutional sectors) improved somewhat. While loans overall and loans to non-financial corporations remained in the negative territory (–2.5% and –4.1% respectively in November), the household loan portfolio expanded by 0.1% in annual terms. In comparison with the three previous months, September–November saw a slight increase in new loans. However, in the first 11 months of the year overall new loans declined by 6.2% as compared to the respective period of 2019.

Due to the holiday spending in December, the growth rate of household deposits might have declined and the account balances of businesses might have increased more swiftly. However, the seasonal impact is likely to be reduced by the restrictions on trade and provision of services. Therefore, the growth rate of overall deposits is likely to remain broadly unchanged. Despite the accommodative monetary policy of the Eurosystem, the outlook for economic growth remains uncertain. Therefore, Latvia's lending trends are unlikely to change in the near future.

Annual changes in domestic loans and deposits (%)

*For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector and the reclassification of the institutional sectors have been excluded.

Textual error

«… …»