Corporate lending ended the year on a pessimistic note

Continuing the trend observed over several previous months, the domestic loan portfolio of banks contracted further in December. Banks evaluate their potential borrowers increasingly more thoroughly and businesses view the economic outlook with growing caution. In combination with significant loan repayments in December, this has led to a monthly contraction in both corporate loans and household loans, with only loans for house purchase preserving a slight increase. As a consequence, the annual rate of change of domestic loans has returned to a negative territory after a several years' break, with a marginally positive annual growth rate reported only in the household loans segment. The monthly growth rate of domestic deposits seasonally peaked in December, yet – against the background of decelerating economic growth – it was slightly lower compared with a year earlier.

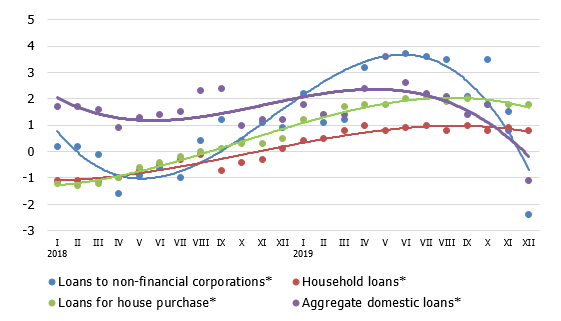

The domestic loan portfolio shrank by 2.3% in December, with loans to non-financial corporations and household loans contracting by 4.1% and 0.2% respectively. This contraction was primarily determined by repayments of short-term loans to several major Latvia's commercial banks. In comparison with the record-lows of November, the amount of new loans slightly recovered in December, albeit remaining lower than a year ago. The annual decline was 23.8% and 4.7% for loans to non-financial corporations and household loans respectively.

Domestic deposits increased by 3.9% in December, with deposits by non-financial corporations and household deposits growing by 4.3% and 2.8% respectively. Looking back at the last month of 2018, the growth rate of household deposits was exactly the same, while that of deposits by non-financial corporations was twice as high. As a consequence, the annual rate of growth for deposits by non-financial corporations declined to 6.2% in December 2019, whereas the respective rate of household loans remained broadly unchanged at 7.4%. Latvia's contribution to the monetary aggregate M3 of the euro area grew by 3.6% in December, with overnight deposits of euro area residents with Latvia's monetary financial institutions, deposits redeemable at notice as well as deposits with an agreed maturity of up to two years increasing. The annual growth rate of M3 stood at 6.2% in December, whereas the above-mentioned deposit categories posted increases of 5.6%, 3.3% and 14.2% respectively.

The annual rate of change in domestic loans (%)

* For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector have been excluded.

Although deposits are expanding and banks have increasingly more resources to invest, the gap between their lending potential and performance is growing on account of high cautiousness of both lenders and borrowers and extremely low risk appetite. As a result, Latvia's domestic loan portfolio is currently the smallest in the EU as well as the euro area in absolute terms. It's ratio to gross domestic product is merely slightly below 40% as compared to the EU average of 87%, with only Romania and Hungary lagging behind. Latvia's economic growth would require a lot more support from lending. Yet with the persisting uncertainty surrounding the development of external demand and ongoing restructuring of the banking sector, that is perhaps something that cannot be expected to happen in the near term.

Textual error

«… …»