Caution should be put first

The developments related to COVID-19 still largely dictate our daily life, even though part of the containment measures have been lifted or eased. However, looking at the health of the economy as a whole, it is obvious already now that it has been affected less than estimated during the state of emergency in spring. The situation has not become critical because of the fiscal stimulus and the government support as well as the Eurosystem's accommodative monetary policy providing the financial sector with additional financial resources.

The prudent financial policy pursued by banks, businesses and households has been one of the main processes characterising the time of the crisis. A slower rise in income and accelerated unemployment growth have served as an incentive to make savings, while preventing households from taking loans without due consideration. Businesses have not been active in using short-term loans as a solution during the peak of the crisis; however, they have quite much preferred the option of deferring the payment obligation offered by credit institutions. Consequently, the relatively pessimistic sentiment of consumers and banks in the first months of the crisis has not driven a significant decline in the loan portfolio, while the risks have been postponed by 6–12 months. In August, with the economic situation improving, the pressure of the pandemic temporarily receding and the consumer and business sentiment indicators improving, lending already recorded a minor increase.

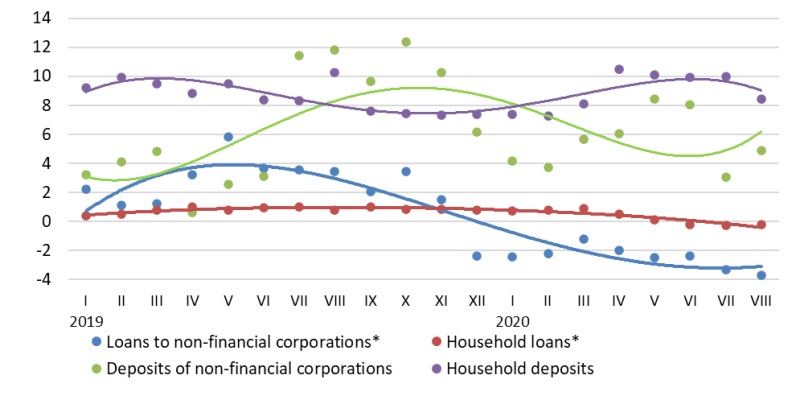

In June–August, the domestic loan portfolio contracted by 0.5%, with loans to non-financial corporations decreasing by 1.4%, but the loan portfolio of households increasing by 0.1% (including loans for house purchase edging up by 0.5%). Lending to non-bank financial institutions also posted an increase (by 1.2%) in this period. The annual rate of change in domestic loans (excluding the impact of the restructuring of the banking sector and the reclassification of institutional sectors) became increasingly more negative: in August, –2.8% for loans overall, –3.7% for loans to non-financial corporations and –0.2% for loans to households. Although the volume of renegotiated loans remained high, new loans which had decreased markedly in the first months of the crisis increased again as of June. Therefore, total new loans even recorded a year-on-year increase of 6% in June–August.

In June–August, domestic deposits increased by 1.5%, with household deposits growing by 1.3% and deposits by non-financial corporations increasing by 5.0%. The annual growth rate of domestic deposits accounted for 6.6% in August, with the respective rates in the household and non-financial corporation sectors standing at 8.4% and 4.9% respectively.

Considerable lending growth in Latvia could be expected no sooner than in 2022 due to the high external risks and uncertainty about the future dynamics of demand. With spending capacity increasing and the retail trade sector recovering, the financing flow from the accounts of households to those of businesses has expanded; however, the risks of a renewed COVID-19 outbreak are unlikely to bring significant changes in the dynamics of deposits in the coming months – deposits will continue to rise; however, their growth rate will slow down gradually.

Annual changes in domestic loans and deposits (%)

* For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector and the reclassification of the institutional sectors have been excluded.

Textual error

«… …»