After a downturn of previous months, growth returns to manufacturing

The manufacturing volume in February grew 1.5% month-on-month according to seasonally adjusted data. Year-on-year, the production volume has increased 13.3% (data adjusted to calendar).

The most substantial annual growth was registered in the production of automobiles and trailers (116.6%), clothing (66.1%), non-metal mineral products (46.7%), computers and electronic equipment (31.5%), metals (30.2%) and ready-made metal products (27.5%). The sharpest decline was observed in the production of other vehicles (ships, boats, railroad engines) (‑40.5%) as well as chemicals (-30.1%).

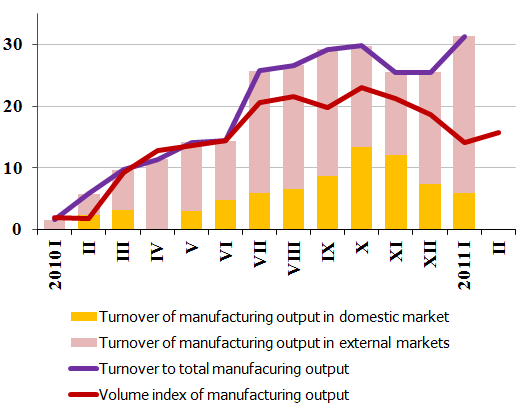

The trends at the beginning of 2011 point to the perseverance of the dominating role of as the main engine driving industry. The turnover in the export markets demonstrates a record high performance whereas the domestic turnover shrinks after the improvement in the second half of last year.

The manufacturing production volume and turnover indexes demonstrate rather different dynamics. Although, for a variety of reasons, these indicators are not perfectly comparable, they do mark a basic tendency. In the second half of 2010, prices grew more rapidly and thus the income of industrialists outpaced the amount of goods produced. These "scissors" increased at the beginning of this year as well. What does that imply about the situation in the industry? The low level of investment limits further increase of production and a maximum load of capacity is the rule in many enterprises. The price rises in the export markets, however, provide many businesses with the opportunity to earn more with the same or even lesser amount of production.

Such a rise in income may prove unsustainable, however; moreover, prices are growing also on imported raw materials and the trade conditions that have improved may at some point deteriorate again. The situation in the world's raw material exchanges is fluctuating, but the overall upward trend in retained. The state tax policies and tariffs set by enterprises have an additional effect on costs. Concern over economic development and budget consolidation measures in several EU countries remains. So many "unknowns" in the background make economic planning, calculating costs and concluding contracts complicated. Of course, there will always be entrepreneurs who use their creativity and willingness to fight, which has been tested in various difficult situations, to win even greater shares of the market in such circumstances, yet the main question remains: for how long will we be able to raise income with the existing capacities?

The European Commission has released the March industry confidence indicator that demonstrates that after the rapid improvement in February, producers' mood has remained practically at the level of the previous month (a small growth of 0.2 points has been observed). The expectations of increased outputs for the next three months show considerable improvement. The improvement of the evaluation of export order amounts for several consecutive months is certainly a positive piece of news. It gives us hope that in March the performance of manufacturing will likewise fall in the good news category.

Manufacturing turnover and production amounts compared to December 2009, %

Source: Central Statistics Bureau, Bank of Latvia's calculations

Textual error

«… …»