Statistical fine points and problems in the metals branch cause a large drop in manufacturing output in January

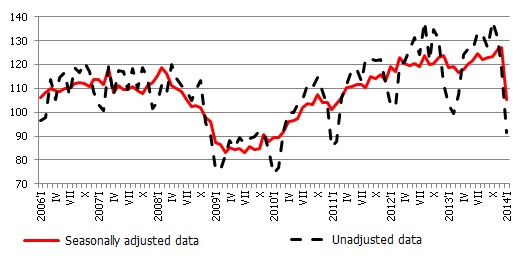

According to the data of the Central Statistical Bureau, manufacturing output in January dropped by 17.3% month-on-month, according to seasonally adjusted data. Thus the year-on-year growth rate (calendar-adjusted) also returned in the negative range: the output volumes dropped by 11.3%.

There is no doubt that such a result is very bad, yet it seems not to give a complete picture of the situation in the branch or point to radical changes in it but is rather a reflection of certain coincidences or statistical nuances. If we evaluate the historic manufacturing time series, it becomes obvious that it is in January that the monthly fluctuation in the branch are the greatest. In other years as well there have been such downturns (albeit not as pronounced), only to correct themselves in the subsequent months. Moreover, the rate of annual growth is still substantially impacted by the last month of full output of "Liepājas Metalurgs" – output dropped off starting February of 2013. The seasonally adjusted manufacturing data have been difficult to interpret historically, because in the post-crisis period, seasonality in the branch has been changing substantially from year to year, which tends to give rise to such "statistical surprises".

It is nevertheless clear that not everything can be explained by statistical fine points. If the seasonally unadjusted rate of annual growth is evaluated (this time, it could probably explain the situation in the branch better), then the greatest contribution to the drop is made by metal production, which in January shrank by 90.9% year-on-year. A drop in output volumes this great cannot be explained only by problems of "Liepājas Metalurgs", its proportion in the branch output was substantially lower. Given the situation in the European metallurgy, it is no wonder that other branch enterprises are also facing problems. There are substantial drops also in the production of clothing, beverages, electrical equipment and mechanisms. No statistics are available for the size of production of pharmaceuticals and other transport vehicles and, in all likelihood, we will not see their data in the future because of confidentiality clauses (1-2 large enterprises are operating in these branches).

Pointing to a lack of fundamental change in manufacturing are sentiment indicators: they in the last few months have been stable and even rising in manufacturing. With the economic situation among the European Union member states gradually improving, external demand, albeit by degrees, is also growing. That is why it can be expected that we will see a rise in the branch output already in February or March data.

In the last few weeks, information on developments in Russia and Ukraine has been dominating in public space. These events will probably have a negative effect on Latvian manufacturing as well. Albeit since the Russian crisis of 1998, the exposure of Latvian manufacturing in eastern markets has dropped substantially, some sub-branches and enterprises are closely related to developments in these markets. The businesses exporting their production to Russia and Ukraine and receiving payment in the currencies of these countries are already experiencing a negative impact: their value has dropped notably since the beginning of this year. A further export slowdown can be also effected by a drop in Russian demand in the conditions of overall economic slowdown. Most likely to suffer are producers of foodstuffs, pharmaceuticals, and various kinds of mechanical equipment: these are the sub-branches of manufacturing that have a high proportion of sales in Russia and Ukraine. At the same time, it should be noted that many manufacturers (in the processing of metals and wood, production of construction materials and chemicals etc.) purchase their raw materials in these same markets, which, with the drop in the value of the currencies of these countries, means that cheaper import prices may come into play.

Illustration. Index of physical output of manufacturing (2010=100), seasonally adjusted and unadjusted data

Data source: CSB

Textual error

«… …»