This Sinking Feeling

A lot has been written about the gradual decline of the middle class. Indeed, the fact that the median wage in the United States has remained more or less constant over the last 20 years leaves one wondering about the value of all this wisdom about benefits of globalization we picked up at school. Irrespective of the explanation behind this increasing inequality, be it technological change or globalization, or even monetary policy[1], it is a valid reason to worry. Large and educated class of middle-income youth, currently piling up student debt and seeing no real future within existing institutions, is a bomb waiting to be ignited.

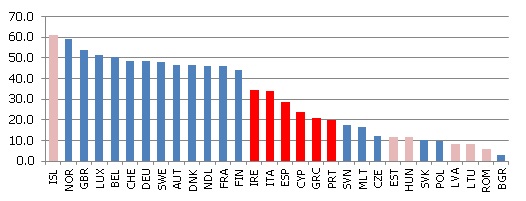

And it is not just people. It seems that a similar process of "waning middle" applies to countries as well. The figure below illustrates the point. In 2008, it seemed that countries in the European Union are gradually converging. The crisis, however, makes one see this convergence story in a completely different light: while the first wave of the 2008 crisis concerned mostly peripheral countries (pink on the figure), the second wave, sovereign debt crisis, hit particularly hard what one may call 'the middle class of Europe' (red in the figure).

Pre-crisis (2007) annual net earnings in Europe (thsd.euros)[2]

If we think about the possible story behind the chart, one obvious explanation is that countries and individuals are not so different. When referring to individuals, the story of growing inequality usually goes like this: technological change has gradually eroded income of people whose skills are further away from the technological frontier but governments and stepped in and postponed the inevitable downward adjustment. In part, it was done directly through increasing government-induced employment, and in part, indirectly by raising regulatory bars in various fields of activities. When this approach seemed to have reached its limit, the growing underlying inequality was compensated with cheap credit[3]. In 2008, the truth broke out and currently the economies are gradually adjusting to the new equilibrium featuring a small class of winners and large legion of underemployed and working in low wage services sector.

With regard to countries, the story looks very much the same: in the hostile environment of advancing globalization, the middle class, trying to "keep up to the joneses" of high-productivity countries, adopted a consumption pattern they could ill afford. As with all bubbles, someone paid for this delusion. Parallel to individuals in mid-2000s, transfers helped (in case of countries - transfers from other governments). First, directly (EU cohesion funds helped to a significant extent all the middle income countries, in particular, in years up to the Eastern expansion in 2004), and then, around 2004, cheap credit came instead and became the next engine of growth. Finally, the 2008 moment of truth came and the countries are converging to a new unknown equilibrium.

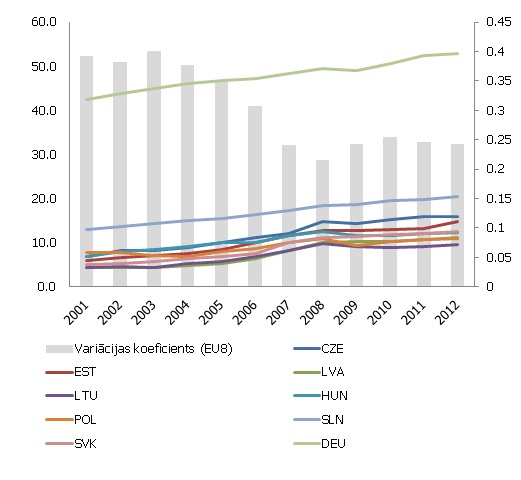

There is one more interesting point to note about this chart. It is surprising how different the world becomes when the veil of PPP calculations is removed! All of a sudden, the countries do not look so different. Against the backdrop of German or Swedish benchmark, the income of (presumably) technologically-advanced Slovakia and (presumably) good-institutions Estonia is not too far from the (presumably) weak-institutions, low-technology Latvia. As a Latvian myself, I indisputably admit that Latvia have both inferior institutions compared to Estonia and inferior degree of industry concentration compared to Slovakia (proudly considering themselves largest per capita car producer of the world). However, at the end of the day, the paycheck we get is not particularly different. Even more so, it seems that Eastern European countries of the 2004 enlargement wave are converging to a similar level income. Estonia and the Czech Republic seem to be fighting against this gravity somewhat and Slovenia has much higher starting position, but the rest of the group is strongly, and somewhat alarmingly, converging. Over the whole period, it seems that countries' similarities dominate their peculiarities.

Dynamics of annual net earnings in Eastern Europe (thsd. euros) [4]

I remember myself as a kid looking up to Hungary around year 1991, it was something close to being a rich, western country. 10 years on and the income difference is still significant, 20 years on, and we are the same.

That brings me to the second not-so-optimistic hypothesis. Maybe, similarly to the developments within societies, also in the "community of countries" has become more like 'winner takes all' society. The future might actually be not a continuum of various development stages, but a binary 'Twin peaks' distribution.[5] Either you are an "advanced country" or you compete with billions of people from other low labor cost countries. Of course, within the European Union that still means reasonably high income due to subsidies, transfers and protectionism, but at the end of the day, if you don't have traditions of being at the frontier of technological progress, you are redundant, irrespective of whether you are a person or a small peripheral nation.

[1] A good overview in a line of blogs at the Economist http://www.economist.com/blogs/buttonwood/2014/03/markets-inequality-and....

[2] Average wage including employer's social security contributions, single person no children, Eurostat, series earn_nt_net.

[3] Markus Christen and Ruskin M. Morgan, "Keeping Up With the Joneses: Analyzing the Effect of Income Inequality on Consumer Borrowing", Quantitative Marketing and Economics, 3 (2005), 149.

[4] Average wage including employer's social security contributions, single person no children, Eurostat, series earn_nt_net.

[5] Like Quah, Danny, 1996. "Twin Peaks: Growth and Convergence in Models of Distribution Dynamics," CEPR Discussion Papers 1355, C.E.P.R. Discussion Papers.

Textual error

«… …»